By Monica E. Oss, Chief Executive Officer, OPEN MINDS

Three weeks ago, we got a reminder that size and scale matter with the announcement that Brightli and Centerstone plan to merge. The combination will create an organization that with $1.1 billion in annual revenue. Together, Brightli and Centerstone have completed more than 45 mergers before this sizable transaction.

Brightli is a Springfield, Missouri-based organization with more than 6,000 associated employees working at more than 220 locations in five states: Missouri, Illinois, Indiana, Oklahoma, and Kansas. In fiscal year 2024, Brightli served 101,691 unique clients, with revenue of $474 million. Centerstone, based in Nashville, has 4,300 employees in 140 locations across six states—Georgia, Florida, Illinois, Indiana, North Carolina, and Tennessee. In addition, Centerstone also provides veteran services nationwide. In fiscal year 2024, Centerstone served 108,012 clients, and it reported revenue of $377 million.

The merger puts the Brightli/Centerstone entity at the top of the list of non-profit specialty provider organizations. This list includes organizations like Merakey (~ $715 million); Devereux Advanced Behavioral Health (~$590 million); Elwyn (~$457 million); Sheppard Pratt (~$457 million); Easter Seals of Southern California (~$445 million); The Harris Center (~$373 million), and Hazelden Betty Ford Foundation (~$220 million).

But recent history has shown us that size is no substitute for strategy or managing financial strength. The past 15 years in the health and human service field has seen many ‘endings’. Federation Employment & Guidance Service, or FEGS, an 80-year-old health and human services provider organization with $250 million in revenue and 1,400 employees, announced its shutdown in 2015. Allegheny Health, Education, and Research Foundation, AHERF, based in Pittsburgh, with $2.05 billion in revenues, filed for bankruptcy in 1998, with $1.3 billion in debt and 65,000 creditors. And most recently, we have the bankruptcy filing of Steward Health, which operated more than 30 hospitals across Arizona, Arkansas, Florida, Louisiana, Massachusetts, Ohio, and Pennsylvania.

But size does bring, if appropriately used, the advantages of financial clout, market share, diversification, and more. In my conversation with Centerstone’s Chief Executive Officer, David Guth, he noted that the merger with Brightli will bring the combined organization a reach that they didn’t have before—and the clout to get significant value-based contracts with health plans and to build the partnership with health systems in their catchment areas. There is also the ability to invest in technology and research. “This enables us to further ensure the precision application of science-based care, allowing us to deliver the right treatments to the right people at the right time, all backed by data, research, and measurable outcomes.”

This high-profile merger, and continuing stream of affiliations in the field, is going to make boards of directors and executive teams of other specialty provider organizations ask themselves the “how big is big enough” question. What they are really asking is two questions. First, does my organization have the financial reserves to stay open if there are significant unexpected changes in revenue? Second, does my organization have the resources—financial, talent, and market momentum—to evolve and succeed in a changing market?

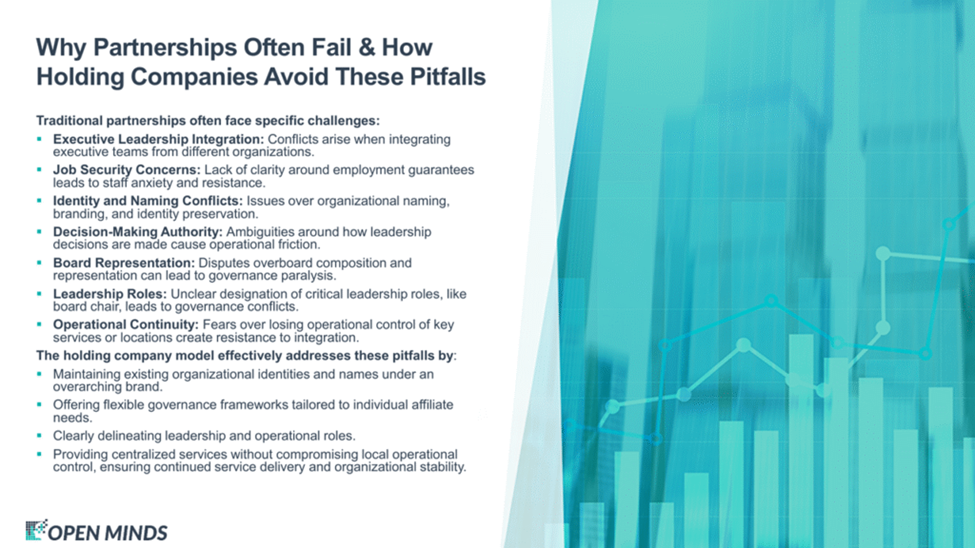

If the answer to either of these questions is not affirmative, most executive teams start to consider some type of partnership—a merger, an acquisition, or an affiliation or collaboration of some type. There is no one-size-fits-all “right” decision. It depends on the organization’s strategic plan and objectives, the market landscape, the organization’s current and future strategic positioning relative to the competition, and the amount of financial resources needed to achieve those strategic objectives. The key is for the organization’s executive team to have a clear strategy in mind – and objectives for what a specific collaboration brings to that strategy.

It’s not simple math—and there are many options. Some executive teams opt to be acquired by a larger organization that has deep pockets and solid market share. Some want a merger of equals. Some are looking to acquire a smaller organization. Some combinations are driven by service lines and other by geography. And there are a host of partnership options—membership in a clinically integrated network, management services organizations, wholly-owned subsidiaries, and/or co-location and co-marketing alliances are just a few. But the key issue is to answer those strategic questions first.

Whatever the strategic issues, what we do know is that executive teams in the health and human services space will need a structured approach to navigating through these uncertain times. And the clout that comes with size and scale can certainly be an asset to make strategy a success.