By Monica E. Oss, Chief Executive Officer, OPEN MINDS

What are the key issues in successful electronic health record (EHR) implementation? According to a report, of 25 Years Of Electronic Health Record Implementation Processes: compliance, collaboration, competence, and cost.

The more pressing issue for most executive teams is how to best address the challenges endemic in each of these implementation process issues. The study authors identified a number of factors that determine the success or failure of an EHR implementation. At the start, once the decision has been made to acquire new technology, executives need to develop a detailed implementation project plan and establish their internal cross-functional teams to support the implementation from planning to launch

In addition, in the early planning process, executive teams should think through the meta-leadership of data and interoperability. This involves collaboration with government agencies, other provider organizations, health plan managers, and more to figure out the need for and the potential for data sharing.

Another key factor is clinician adoption of the technology. This means providing job-specific, flexible training embedded in workflows to ensure staff skill development. But training alone is not enough. Once launch training is over, implementations are more successful with on-going support including access to power users and peer networks.

Finally, from the start of the tech strategy process through tech selection and launch and into long-term integration and optimization with service delivery, executives need be constantly focused on improving the value of the technology to the organization. This “value” can be measured in clinician productivity, and/or consumer outcomes, and/or revenue improvement I had a chance to hear about the “math” of getting a maximal return-on-investment (ROI) from an investment in EHR technology at our recent OPEN MINDS Executive Roundtable, The ROI Of Strategic Technology: The Easterseals Midwest Case Study. Jeff Arledge, Executive Vice President and Chief Financial Officer of the organization, spoke to the many issues that can contribute to—or detract from—a positive ROI.

Founded in 1971 and based in St. Louis, Easterseals Midwest is a $130 million non-profit serving individuals with developmental disabilities, including autism. The organization’s decision to implement a new EHR stemmed from a strategic imperative: to consolidate data from two non-integrated EHRs that relied on manual data collection and provided limited reporting capabilities, as well as no dashboard features, while also reducing costs, enhancing billing performance, and enabling growth through operational efficiency.

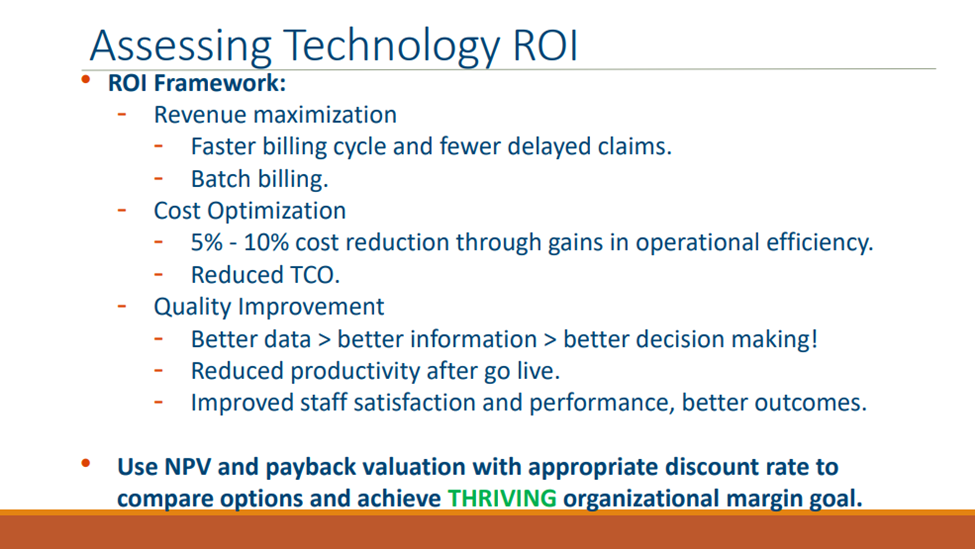

To calculate the ROI of their EHR, Mr. Arledge recommended paying particular attention to revenue maximization and cost optimization. While he acknowledged the value of “soft” benefits, such as staff satisfaction, quality improvement, and operational efficiencies, the ROI emphasis must be placed on “hard” dollars—measurable financial outcomes.

“There’s a plethora of things that you can include in an ROI, but it comes down to revenue maximization, cost optimization, and quality improvement,” said Mr. Arledge. “I don’t like including soft dollars in an ROI, so hard dollars are quantifiable dollars. Revenue maximization and cost optimization are easier to quantify. Soft dollars are things like improved staff satisfaction or getting rid of manual processes. That should provide capacity for your staff but it’s hard to quantify and a harder one to realize. So, I focus on the hard dollars when calculating ROI, but I don’t ignore the efficiencies.”

Mr. Arledge also suggested that executives commit to using net present value (NPV) and internal rate of return (IRR) over more simplistic payback or break-even methods. NPV evaluates the profitability of an investment by comparing the present value of its future cash inflows to the initial investment. IRR indicates the annualized effective compounded rate of return that an investment is expected to generate. Together, these metrics account for the time value of money and better reflect the strategic value of long-term investments.

“NPV and IRR are two standard, basic metrics that need to be used,” said Mr. Arledge. “Payback and break-even analysis are easily relatable to non-finance folks, but they aren’t good quantifiers of an investment. Please use NPV.”

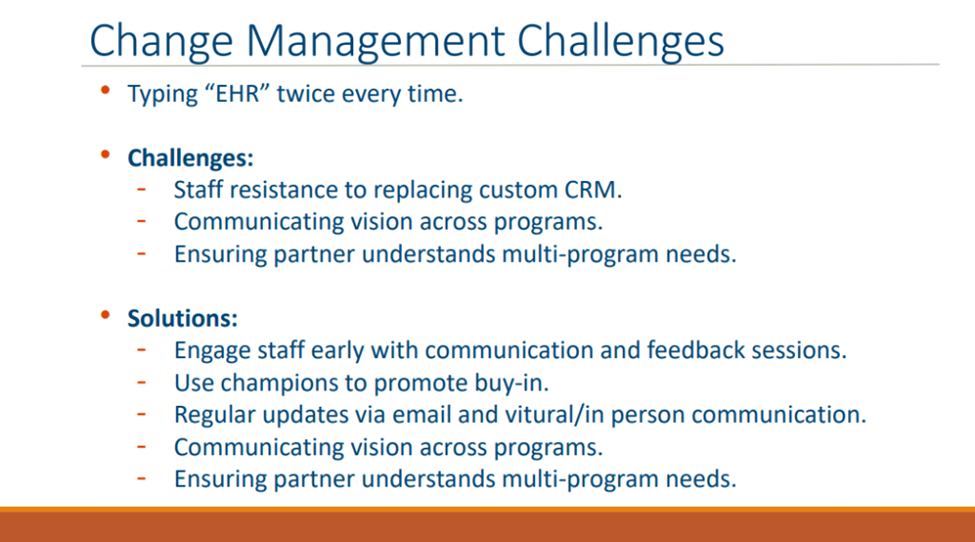

The question is what are the factors that drive—or derail—a positive ROI. He underscored two persistent challenges: selection fatigue and change management.

The fatigue issue is a real one. Since the pandemic, provider organization teams have felt that change is a constant. And as the HER implementation process progresses, it’s easy for staff engagement to diminish. To counter this, organizations need leadership with stamina. They need to anchor the work in a shared strategic vision and rigorously monitor the team’s alignment with both process and purpose.

The other issue is resistance to change and the need for change management. “We all typically talk about change management. We had a lot of challenges on the front end,” said Mr. Arledge. “For example, we had a team with a customized system that worked for them and was built how they wanted it, but it wasn’t a great implementation. It didn’t have a great implementation partner, and it wasn’t an integrated solution that met our needs. We did a lot of communicating with that group about the change.”

He continued, “Engage staff early with the why behind it and what’s in it for them. Then try to garner champions in the organization, those subject matter experts who understand the strategic goal behind why you’re doing it and the need for it. I have my executive peers champion the need for this, but it helps to garner that throughout the organization.”

As we look ahead to technologies—old and new—as essential to financial sustainability, the issues around optimizing the return from tech investments is going to only grow. Mr. Arledge put that in context: “Our goal is to be a thriving organization. I have specific positive margin targets for every program. For programs where we can’t make a profit, I want us to think and act like a business with a mission, so that we incur less financial loss. We are a thriving organization, not just a financially sustainable one. I like that distinction because getting that tech ROI means we can invest in growth, which requires, quite frankly, higher margins.”