By Monica E. Oss, Chief Executive Officer, OPEN MINDS

Greeting from Philadelphia and the wrap of the first day of the 2023 OPEN MINDS Technology & Analytics Institute. It was an exciting day with 500 executives from all around the country focused on issues of technology and strategy.

Timing is everything when it comes to technology adoption in health and human service field. There are a few market factors to consider. The first—there are huge amounts of capital being invested in health care technology. Last year, $27.5 billion in the U.S. alone—30% higher than 2020 and more than double that of 2019. More than $125 billion since 2016.

But despite this huge investment in technology, the field has been slow at adoption of new tech. It took the pandemic to drive adoption of telehealth. But technologies like remote monitoring, eCBT, web-based scheduling, measurement-based care, prescription digital therapeutics, and treatment decision support are slow on the uptake. The 17-year “science to service” lag in health care (it takes almost two decades for 14% of relevant consumers to get the benefit of new science) seems to be holding. The reasons behind the lag are many—financial misalignment, reimbursement models, regulation, culture, and practice models to name a few.

A few factors may override this lag in tech adoption. Health care budgets are stressed—whether Medicare, Medicaid, or employer-sponsored health insurance. Employer health insurance costs rose 7% this year and analysts predict a 7% to 9% increase next year. Medicare spending (net of income from premiums and other offsetting receipts) is projected to rise from 10% of total federal spending in 2021 to 18% in 2032. As a result, payers (and consumers) are more focused than ever on the ‘value’ of each dollar they spend on health care—and tech-enabled systems can decrease costs and improve performance.

And there is the competition. When it comes to the digital transformation required to compete on value, new entrants in the field—particularly provider organizations offering services in retail settings—are pushing the envelope in terms of rapid access, consumer convenience, and low cost.

So where are specialty and primary care provider organizations in their digital transformation—and adoption of key technology? Adoption of EHR systems and telehealth technology is over 80%—the rest not so much. And high-growth areas (this year to last year) are in clinical decision support and technology supporting value-based contracting and population health. Those were the findings of our 2023 technology adoption survey, reported in The Tech-Enabled Provider Organization: The 2023 OPEN MINDS Health & Human Services Technology Survey.

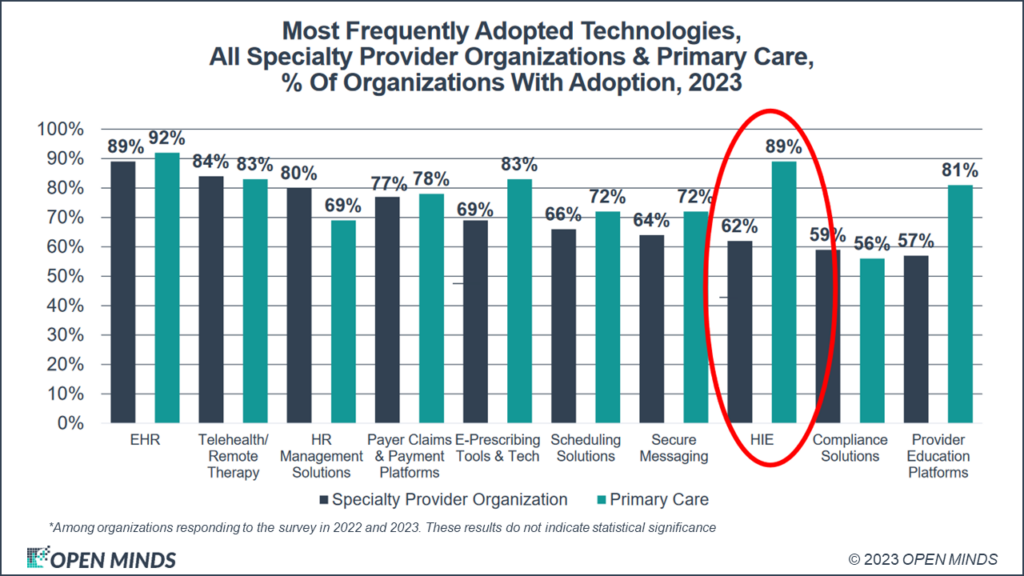

The current snapshot is that 89% of specialty provider organizations have an EHR platform, 92% of primary care provider organizations. Telehealth technology platforms were in place for 83% and 84% of specialty and primary care provider organizations, respectively. No other category of technology had 80+% adoption by both specialty and primary care provider organizations.

An interesting difference in adoption is that 89% of primary care provider organizations have health information exchange (HIE) technologies. That adoption level among specialty provider organizations is 62%. This is an indicator of how ready, or not, specialty provider organizations are to participate in integrated care. Among specialty provider organizations, HIE adoption is 71% for behavioral health organizations, 53% for IDD/LTSS organizations, and 56% for children’s services organizations.

High-growth areas (comparing last year to this year) are in clinical decision support and technology supporting value-based contracting and population health. There was an 11% increase in adoption of clinical decision support technology and a 33% increase in adoption of consumer disease state management technologies. In the population health domain, there was an 18% increase in both HIE technology and in population health management technology like risk stratification, analytics, and predictive analytics.

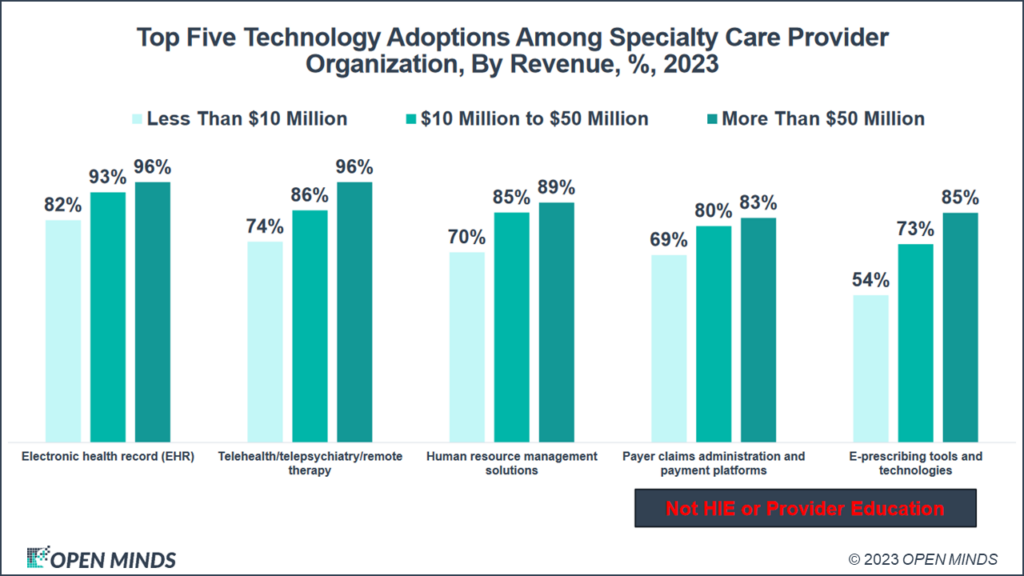

Size matters a lot in tech adoption. For the largest organizations (over $50 million in revenue), there is a 20%+ adoption rate of HIE technology, e-prescribing technology and scheduling solutions compared to smaller organizations. For mid-sized organizations in the field ($10 to $50 million in annual revenue), the median technology budget was $400,000 and $750,000 for specialty and primary care provider organizations, respectively. These organizations had 4 and 5 FTEs of technology staff, respectively.

How health and human service provider organizations succeed with digital transformation—and leverage technology to create competitive advantage—will be a defining factor in future success. The key for every executive team is to sync their strategy for financial sustainability and growth with their tech strategy—and take advantage of the opportunities that new technology adoption brings.