By Monica E. Oss, Chief Executive Officer, OPEN MINDS

Most executives of most organizations (not just in health and human services) are trying to cope with the chaos in the marketplace—and the uncertainty that it brings to leadership and management. Tariffs, deportation targets, grant funding, regulatory guidelines, and more seem to change on a daily basis.

For our field, the market uncertainty is driven by a changing federal policy, big shifts in health plan market positioning, and breakthrough technology innovations. On the federal level, there have been a steady stream of significant changes over the past 120 days. And at this point, the health care-related provisions in the budget bill coming out of Congress is uncertain (For those of you who missed my roundtable session today, Successfully Managing Through Chaos: Perspectives For Health & Human Service Executives – Part 2: An Executive Framework For Leadership & Management, there is a summary of key health care provisions in the House version of the budget bill.)

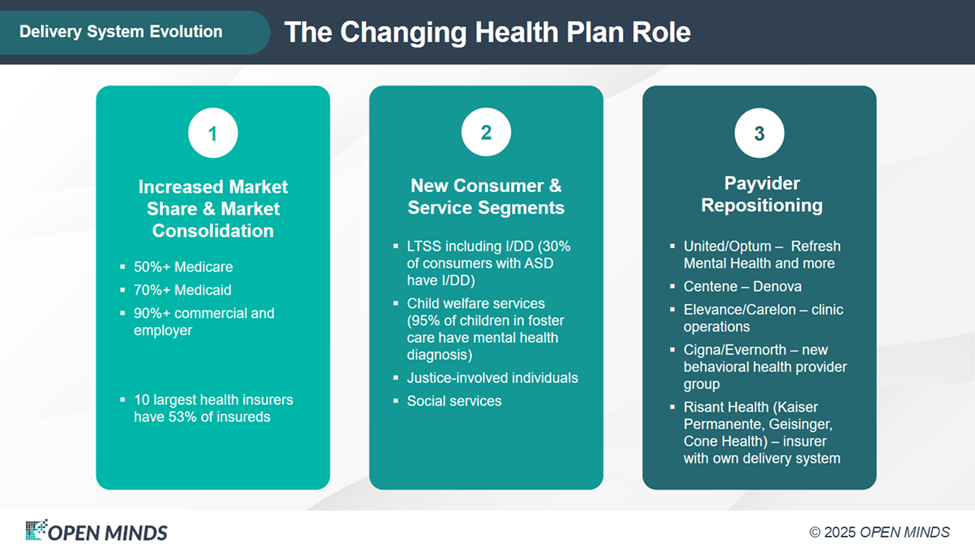

The health plan landscape is also changing. Health plans are consolidating and transforming into full-scale delivery system operators. Health plan executives are also facing a likely reduction in the number of Americans with health insurance coverage due to the pending budget bill.

At the same time, first quarter data shows that medical loss ratios (MLRs) are deteriorating, due to rising medical costs. Health plans reported higher medical losses from Medicare, Medicaid, and commercial business lines with the MLR increase due to both higher utilization and higher provider reimbursement levels. For the Medicaid population, the post-pandemic redeterminations, which disenrolled thousands from Medicaid plans, heightened the average acuity levels of members. And, while Medicare health plans received a 5.1% rate increase for 2026, the impact will not be realized in 2025. In response, insurers are streamlining operations and diversifying plan offerings to manage financial risk.

To explore these market dynamics—and their implications for provider organization executives, I sat down with my OPEN MINDS colleagues, Senior Advisor, Jonathan Evans, and Chief Strategy Officer, Paul Duck in the recent Executive Roundtable session, Successfully Managing Through Chaos: Perspectives For Health & Human Service Executives Part 1: The Trends Shaping The Market & Strategy. Their take is that margin compression due to a combination of federal policy and health plan practices is a major threat to provider organization financial sustainability. That margin compression is due to eliminated federal grants, changing Centers for Medicare and Medicaid Services (CMS) policy on health related social needs, and growing health plan influence over clinical practices and reimbursement rates.

“Of the cascading impacts, what sticks out right now is the change in Medicaid funding, and in waiver flexibility, having a profound impact,” Mr. Duck said. He noted in particular the refinements to reimbursement terms, increasing requirements for outcomes-based contracting, and the narrowing of provider panels. This is due in part to increased expansion of health plan owned and operated provider services—heightening the competitive pressure on independent provider organizations.

My colleagues also noted the likely change in relationships between health plans and provider organizations. Health plans will increasingly have more leverage—and they will be looking for provider organizations to “solve” their MLR problems.

“Repositioning their role is key for provider organizations: health plans want providers to act like partners, not just claims generators… My challenge to my colleagues in the community mental health centers is not to accept unsustainable contracts. I would encourage you to get your boards to support you to say no to unsustainable rates,” Mr. Evans said. “I don’t see payers as showing a great deal of historical interest in mitigating any of their margins so more dollars can get to care. I just haven’t seen it.” “There are going to be more preferred provider models. The era of automatic network participation is over. Performance is essentially going to end up being the price of entry,” Mr. Duck said. “The days of passive contracts are over. Health plans want data. They want results. And they want proof that you can deliver on outcomes, not just services… And while integration or whole person care may be challenging today, the health plans have been hard-wiring themselves to make this part of their contracting requirement. It’s not just a clinical ideal. I think it is going to become, and it will stay, part and parcel of contract requirements.”

My colleagues also noted that in this mix is the increasing influence of private equity investments—though the investments on the tech side far outweigh investment in service provider organizations. “As a result of increasing private equity investments, you’ll see more mergers and acquisitions activity—not because organizations want to grow, but because they have to, to survive,” Mr. Duck said.

“There’s immense interest from private equity in having behavioral health in their portfolio. I would encourage even non-profit organizations to consider additional financial pipelines or spin off a for-profit subsidiary where they can contract with private payers or cash payers,” Mr. Evans said.

With so many variables in the market and so many concerns, the most important thing is clarity on goals, objectives, and how to achieve them: “Focusing on strategy for your organization becomes paramount. Instead of chasing shiny objects or one-off solutions, initiatives have to fit into a framework and a platform. And it has to be strategic,” Mr. Duck said.