By Monica E. Oss, Chief Executive Officer, OPEN MINDS

For health care executives, 2024 was not a great year for revenue cycle management (RCM). A recent analysis of claims and billing data concluded what most executive teams know—it’s harder to get paid than it was a year ago. The February 2025 Revenue Cycle KPI Benchmarking Quarterly Report, a year-over-year analysis of 2023 and 2024 data from thousands of health care organizations, found that initial claims denial rates are up 2.4% and final denial rates as a percent of net patient revenue are up 0.4%.

Not surprisingly, accounts receivable (A/R) days are up 5.2% year-over-year and A/R greater than 90 days is up 2.1%. In the one bright spot in the survey data, bad debt as a percentage of net patient revenue declined 5.7%.

A companion analysis, May Revenue Cycle KPI Benchmarking Quarterly Report, reported an average of 35% of claims were at 90+ days in collections, that 1.4% was the average bad debt as a percentage of gross patient services revenue, and 2.8% was the average of final denials as a percentage of net patient service revenue. Point of service cash collections from consumers averaged 18.9%.

The question for executive teams is how to improve collections and reengineer their RCM to decrease the amount of services delivered that are not paid for. My colleagues, OPEN MINDS Senior Associates Ray Wolfe and Sharon Hicks, provided some perspectives on changing RCM best practices in a recent OPEN MINDS Executive Roundtable, Re-Engineering Revenue Cycle Management To Drive Strategy.

Their advice? Adopt an “RCM excellence” model aligning four critical phases of the revenue cycle—intake/admission, clinical service delivery, billing, and collections—with the organization’s broader strategic goals.

“Executives often see RCM as pure operations, and it can be,’ said Ms. Hicks. “But if you also think about operational success as a strategy, focused leadership can help you make strategic decisions and service line decisions to protect profitability.”

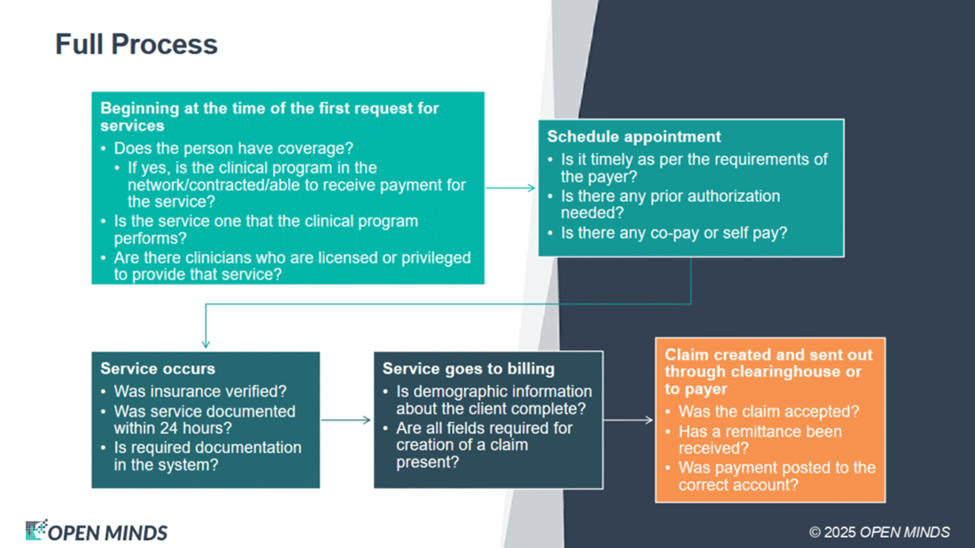

Ms. Hicks and Mr. Wolfe stressed that at the point of intake/admission, systems must be designed to ensure the organization can be paid for the services it provides. That means verifying insurance coverage and eligibility, determining whether the provider is in-network, and reimbursable with credentials that match the services, and securing all necessary authorizations before care begins.

Ms. Hicks explained—“The very first question is, will we get paid for providing the service? Often front-facing staff are really trying to focus on making sure that they have the right clinical service and availability in the clinical program that they need. But the reality is that we should not schedule appointments with people when we have not been able to ascertain if we’re going to get paid for providing the service. That means that we may have to refer people out to other programs or send them back to their payer to get information about who’s in network.”

Clinical service delivery workflows also need to be aligned with RCM processes. Clinicians must submit complete and accurate notes as quickly and accurately as possible within compliance guidelines—clearly stating what services were rendered, why they were necessary, and what occurred during the encounter. Failure in these first two steps means downstream billing and reimbursement are compromised.

“The clinician has a role in revenue cycle management,” said Ms. Hicks. “It’s not enough for the clinician to say they are able to provide this service because when organizations and payers audit the charts, they need to be able to read a note that actually describes what was done, what the effort was, why it was done, and then what the effect of the services was. It’s the clinician’s role to make sure that those things are happening. Many organizations have taken that responsibility away from clinicians and put it into the quality management, risk management, or even the billing department. But it’s important that clinicians understand how the entire process works.”

For optimal collections, my colleagues emphasized that billing should be digital-first and automated wherever possible. “Everything that can be automated should be automated, even those things that seem minor,” said Ms. Hicks. “Anything that can be automated is going to create efficiencies for you. There is no reason to do things on paper.”

Finally, there is the issue of managing collections—which they advised must be addressed proactively, with mechanisms in place to ensure the timely posting of all A/R. “If the front-end problems at both the registration desk and at the clinical site are larger than what the billing department is staffed to manage, you’re going to end up with unpaid claims that are going to stretch out in age,” said Mr. Wolfe. “Follow-through for collections on a regular basis is critical to getting things done correctly. Sixty percent of your collections should happen in under 40 days. The next 25% should be collected within the 60-day window, and then 90 days or more should only be 15%.”

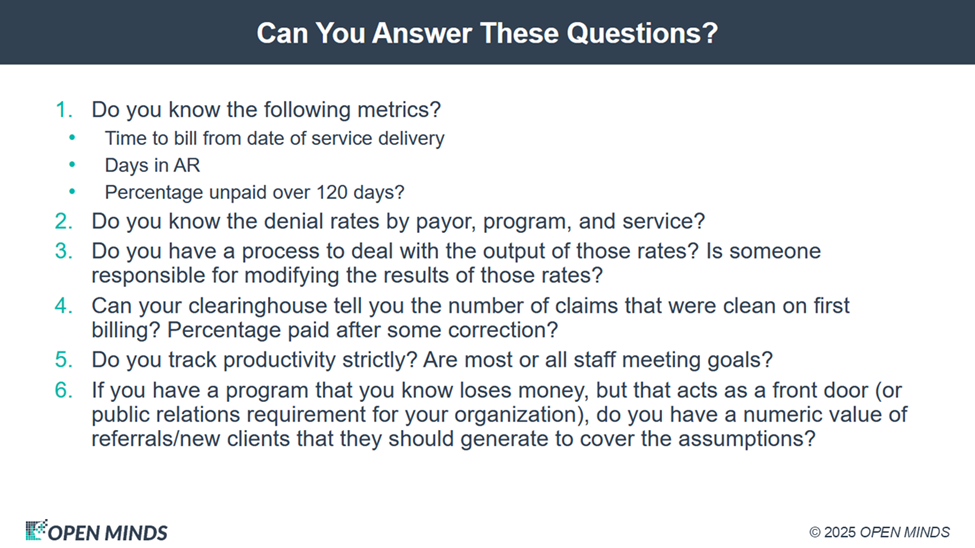

Across these four domains, executive teams should be tracking the relevant performance metrics. These include no-show rates, time to bill, documentation accuracy, clean claim rates, denial trends, cash collections as a percentage of net patient revenue, aged A/R, cost to collect, and staff productivity, among others.

“Having the reports is monumental,” said Mr. Wolfe. “They reveal program-specific and payer-specific trends that help us elevate both the system as a whole and its individual parts. This lets you set and manage critical program metrics. Do your leaders know the volume of services that must be billed and reimbursed at each site? Do they understand claim denial patterns by service type and payer? Can they identify which programs are loss leaders and which programs must subsidize them to cover the assumptions?”

Ms. Hicks summarized it best—“Sophisticated, strategy-supporting RCM is not simply about chasing payments. It’s about embedding financial intelligence into the daily operations of the organization and managing to performance measures for every step along the revenue cycle.”