By Monica E. Oss, Chief Executive Officer, OPEN MINDS

I was not surprised to see another analysis confirming the concentration of health care spending among a small part of the population and the effects of comorbid conditions. The new study, Concentration Of Healthcare Expenditures & Selected Characteristics Of People With High Expenses, United States Civilian Noninstitutionalized Population, 2018-2022, found that the top 1% of Americans accounted for 21.7% of total health care spending, while the bottom 50% accounted for just 2.8%. On average, individuals in the top 1% spent $147,071 in 2022.

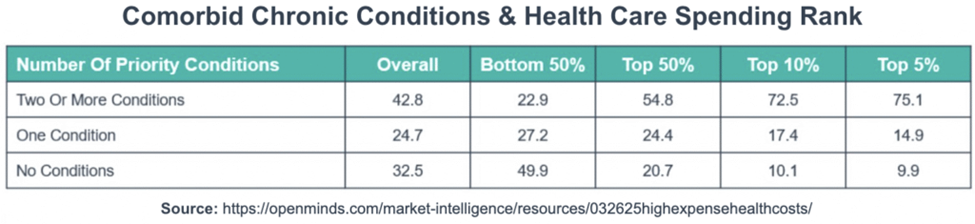

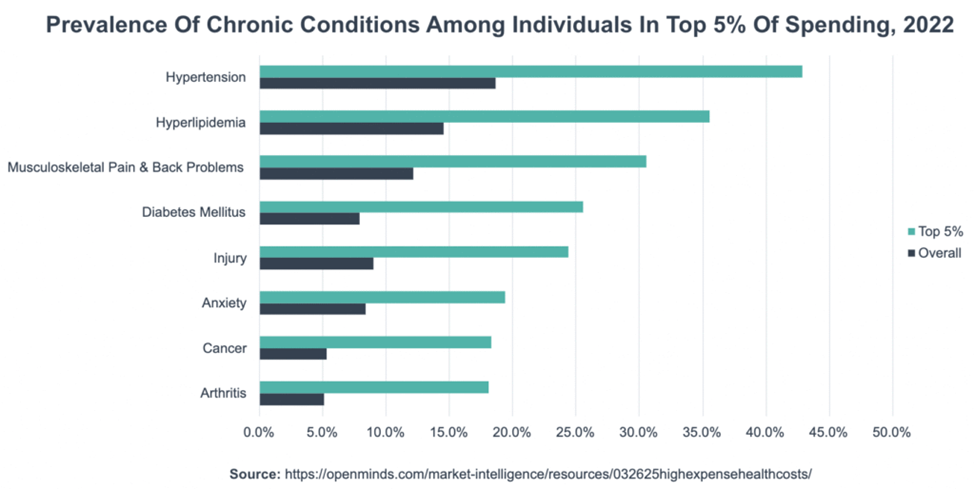

Individuals in the top 5% of spending—those with annual expenditures of $30,206 or more—were disproportionately older (40.5% aged 65+), predominantly White (72.4%), and overwhelmingly medically complex. Among this group, 75.1% of adults had two or more AHRQ-designated priority conditions, including hypertension, diabetes, arthritis, asthma, cancer, and mental health disorders. Behavioral health conditions like anxiety were frequently co-occurring, highlighting the intersection between mental and physical health burdens in driving cost.

People in the bottom 50% of spenders—who averaged less than $1,361 annually—relied primarily on ambulatory services. In addition, they had a much higher out-of-pocket burden—26.2% compared to 8% in the top 5%.

Interestingly, Medicare and private insurance paid for approximately three-quarters of expenses for people with the top 5% of expenditures (30.8% for Medicare and 44.4% for private insurance), while out-of-pocket payments comprised only 8% of expenses for this group. For people in the bottom 50% of expenses, out-of-pocket payments accounted for over one-quarter of their expenditures (26.2%), while Medicare payments accounted for only 6.1%.

The question is what are the implications of—and the opportunities in—this persistent health care spending situation for community-based provider organizations. I reached out to my colleagues—OPEN MINDS Senior Associate Sharon Hicks and Dr. Stuart Buttlaire, OPEN MINDS Vice President of Clinical Excellence and Leadership—for insights.

Ms. Hicks emphasized that it is the ability to manage the total costs of these high needs consumer cohorts that health plan executives are most concerned about. Health plans have developed efficient approaches to manage the needs of people in the bottom 95% of expenditures but not the 5% of people using the most resources. Her take is that in every market, there is an opportunity to identify these consumer groups and better coordinate their care—reducing total cost of care.

Dr. Buttlaire stressed that the individuals in the top 5% are not a monolith. High-performing organizations stratify high-utilizer populations by the underlying drivers—avoidable hospitalizations, polypharmacy, behavioral crises, or untreated substance use—and match interventions accordingly. Tailored models like community paramedicine, ACT teams, and pharmacy-led risk management deliver better results when aligned with consumer need.

Behavioral health, he noted, is the unifying factor across these cohorts. High-cost consumers are frequently dealing with anxiety, depression, or trauma histories that complicate adherence and care coordination (in fact, in the analysis, almost 20% of individuals in the top 5% suffered from anxiety disorder).

His observation was that organizations that succeed in managing the needs of these consumers are the ones that deploy measurement-based care, behavioral health navigators, and regular psychotropic medication reviews—particularly for medically complex seniors. He also noted that the most successful programs not only integrate physical and behavioral health but also blend care coordination, social determinant supports, and payer-facing utilization management. He referenced Kaiser’s model as a best practice example: cost reductions were driven by co-located behavioral health, embedded care coordinators, and real-time analytics aligned with actuaries.

Both Ms. Hicks and Dr. Buttlaire stressed that financial alignment in the relationship between health plans and provider organizations is crucial. Capitated contracts, shared savings, and collaborative payer relationships make it possible to reinvest in the high-touch care models these consumers require. Without some type of value-based reimbursement, even the most clinically sound strategies will struggle to scale.

As the U.S. population ages—and the prevalence of chronic conditions continues to rise—the ability to deliver on whole person approaches to integrated care will be the growth opportunity for most community-based provider organizations. But these are opportunities that require executive teams to assess their clinical programming, financial infrastructure, and organizational culture.