By Monica E. Oss, Chief Executive Officer, OPEN MINDS

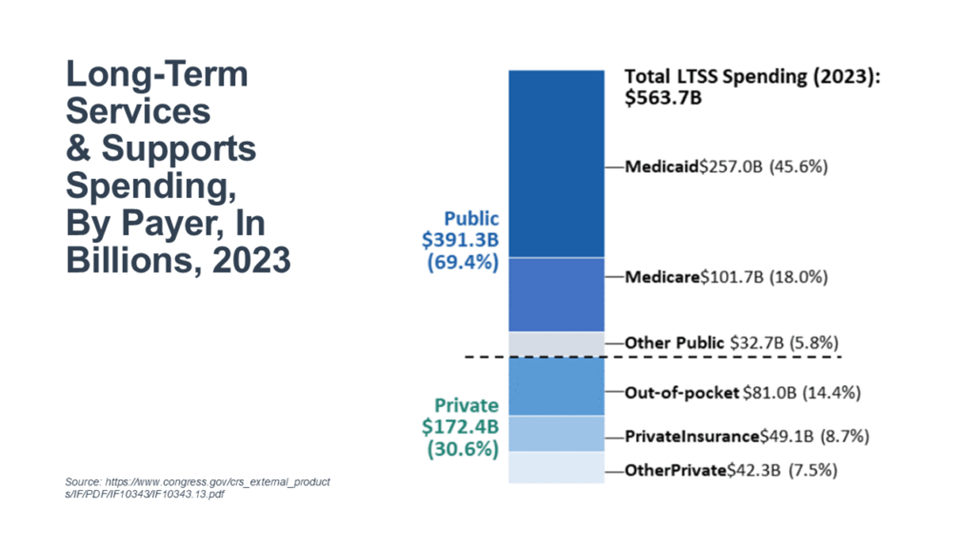

Total long-term services and supports (LTSS) spending was $563.7 billion, or 13.7% of the $4.1 trillion spent on personal health care in 2023—see Who Pays For Long-Term Services And Supports?. Public payers accounted for most of it at 69.4%—though that share has shrunk from 70.4% in 2022.

Medicaid was the single largest payer at 45.6% ($257 billion), up from 42.1% in 2014, with LTSS consuming 33.2% of Medicaid personal health spending. Total Medicare spending on LTSS included skilled nursing facilities (SNFs) at 8.5% ($48 billion) and home health at 9.5% ($53.6 billion).

Private sources accounted for 30.6% ($172 billion) of spending, up from 29.6% in 2022. This included out-of-pocket at 14.4% ($81 billion), private insurance at 8.7% ($49.1 billion), and other private funds (philanthropy, foundations, and corporations) at 7.5% ($42.3 billion).

In this study, LTSS expenditures include payments made for services in nursing facilities and in residential care facilities for individuals with intellectual and developmental disabilities (I/DD), mental health conditions, and substance abuse issues. LTSS spending also includes payments for services provided in an individual’s own home, such as personal care and homemaker/chore services (e.g., housework or meal preparation), as well as a wide range of other community-based services (e.g., adult day health care services). The data does not reflect care provided by family members, friends, and other uncompensated caregivers.

For public payment, eligibility requirements and benefits provided by these public payers vary widely. And across the public payers, none are designed to cover the full range of services and supports that may be required by individuals with long-term care needs.

Out-of-pocket spending in 2023 accounted for 14.4% of the total—$81.0 billion. This includes deductibles and copayments for services that are primarily paid for by another payment source, as well as direct payments for LTSS.

Under Medicare, there are daily copayments for SNFs after a specified number of days and no copayments for home health services. In addition, some private health insurance plans provide limited SNF and home health coverage, which may require copayments. In addition, private long-term care insurance (LTCI) often has a waiting period for policyholders that requires out-of-pocket payments for services for a specified period of time before benefit payments begin. Under those policies, once individuals have exhausted their Medicare and/or private insurance benefits, the LTCI plans are responsible for covering the full cost of LTSS.

With respect to Medicaid LTSS, individuals must meet both financial and functional eligibility requirements. Individuals not initially eligible for Medicaid and not covered under a private LTCI policy must pay for LTSS directly. Eventually, they may spend down their income and assets to meet the financial requirements for Medicaid eligibility.

For executives of organizations serving the LTSS market, the rules are complicated—and likely to get more complicated. Understanding the market, the payers, and the eligibility and benefit coverage of each payer source is critical.