By Monica E. Oss, Chief Executive Officer, OPEN MINDS

What keeps chief financial officers (CFOs) and CFOs-to-be up at night? According to a new survey, Finance Trends 2026: Navigating The Expanded Scope Of Finance, five key issues top their list of concerns.

Two of these priorities are typical financial concerns—the need for better management of day-to-day cash flow and for reducing current costs. But three top-of-mind concerns in the finance department are outside of the typical CFO purview—new external market factors (like tariffs and changing policy); the effect of new technology; and the need for diversification through new services.

In this uncertain health and human service landscape, CFOs and their fellow executive team members are shifting to new leadership and management practices with a focus on three areas. First, executive teams are improving the value of their services through data-driven discipline in managing their organizations. Secondly, executive teams are taking leadership roles in the adoption of technology across the organization and the recruitment of tech-savvy team members. And finally, executive teams are stepping up their focus on scenario-based strategy—in particular agile strategy that increases the speed for responding to market changes. Interestingly, this has lead to finance departments playing a more critical role in strategy development in over half of organizations (57%).

We got a look at how one organization, Monarch, realigned its strategic decision-making model in our recent 2025 OPEN MINDS Executive Leadership Retreat session, Strategies For Strengthening & Diversifying Revenue Sources: The Monarch Case Study. Blake Martin, president of Monarch, shared his organization’s enhanced approach to strategy and to diversifying its revenues.

Monarch is a $118 million provider organization in North Carolina and Rhode Island, with 1,600 employees. It serves 27,000 consumers each year—individuals and families affected by mental illness, substance use disorders, intellectual and developmental disabilities, and traumatic brain injuries—with services ranging from outpatient therapy and mental health services to residential services and day programs.

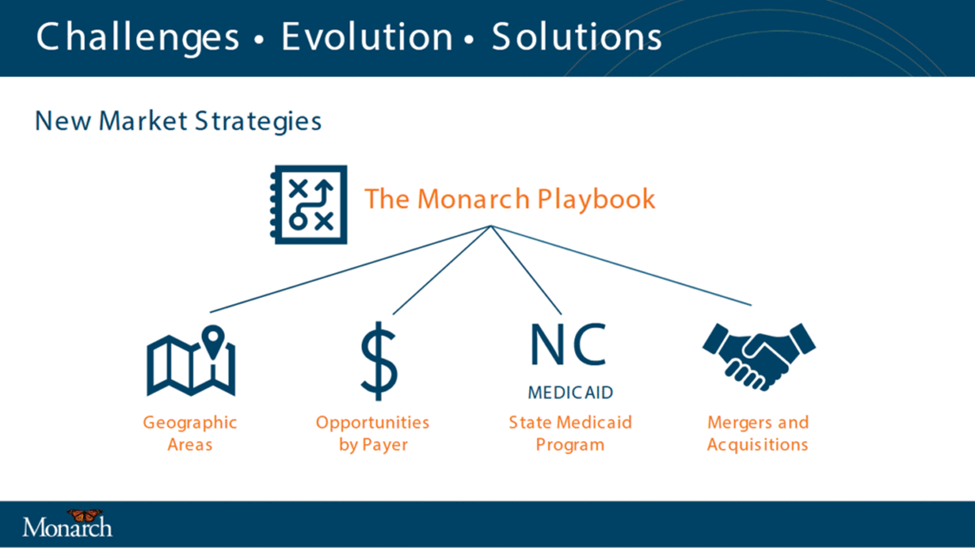

Mr. Martin shared that Monarch has evolved into a large, community-based provider organization with more than 250 payer contracts, spanning Medicaid, Medicare, commercial insurance, and state-funded services. Their strategic transformation began amid increased volatility in the North Carolina Medicaid market that included managed care expansion and increased financial risk. In the face of this volatility, the Monarch executive team found that its data and analytics capabilities were limiting its ability to forecast revenue performance or model payer risk. As a result, the organization launched a tripartite strategy transformation—including investments in service line diversification, data analytics, and dedicated business development resources.

These investments resulted in some important outcomes. On the diversification front, Monarch has created ‘whole person model’ service lines and pursued pilots with Medicaid managed care organizations (MCOs), hospitals, and commercial insurers to test shared-savings, at-risk, and bonus-based contracts. By using analytics for daily payer and contract performance management, Monarch was able to show a 26% average reduction in PHQ-9 depression scores over six months and reduced emergency department (ED) utilization. And the Monarch team used those new services and improved performance results to negotiate payer increases up to 140%.

Mr. Martin offered other executives two pieces of advice on making this strategic approach effective. First, use data as the basis for management and quantifying value. And be prepared to plan big but fail fast.

He noted that data must anchor all business development and diversification decisions. His view is that strategic decision-making without supporting analytics is a gamble almost certainly destined for failure: even if it works, the organization won’t have the real-time data to manage success. “We now all live in the show-me state,” said Mr. Martin. “We must prove ourselves. We must have that data, and more data.”

And that data is key to quantifying value for consumers and payers. “One of the things you must know is your value,” said Mr. Martin. “You can’t diversify and do the same old thing. If you don’t have a value proposition, you’re just going to get fee-for-service. You’re going to sign up, you’re going to credential, and they’re going to move you along.”

Finally, he believes that access to the data and a clear value proposition embolden executives to “plan big” with innovative pilots that have clear metrics tied to cost and engagement. But this same data also creates the ability to plan for “fast failure” if the outcomes aren’t there. Mr. Martin emphasized that with a data-driven approach, pilots can function both as innovative tools and risk-management mechanisms that test contract models, data capacity, and workforce alignment. And when they work, executives can scale quickly.

“We’re doing pilots all throughout revenue diversification,” said Mr. Martin. “Just don’t be afraid. Figure it out. Pilot, fail fast, but plan big. Try a lot in a small amount. Just remember that it’s got to be scalable. You’ve got to understand the scale of it.” The Monarch experience emphasizes the importance of coordinated investments in analytics and business development to support revenue diversification strategies. As Mr. Martin said, “Your analytics should have the ability to crunch the data as you diversify your revenue. You’ve got to know what the data is.”