By Monica E. Oss, Chief Executive Officer, OPEN MINDS

The political conflict is over. The government shutdown has ended. And the Affordable Care Act (ACA) premium subsidies will not be renewed.

With the turn of the new year, the enhanced premium tax credits (PTCs) enacted during the pandemic have expired. These tax credits allowed for an extended eligibility income range for people to receive health insurance subsidies—above the original 400% of the federal poverty level. Now, eligibility for subsidies will be limited to consumers with incomes up to, but not exceeding, 400% of the federal poverty level.

Compounding the financial issue for consumers in this group is that the ACA marketplace health plans have seen an 18% to 20% raise in median rates. As a result, ACA premium payments in 2026 are more than doubling and an estimated 4.8 million people are expected to lose or drop their health insurance coverage.

The question for provider organization executive teams is estimating the impact in specific states. That state-by-state analysis is the focus of our new OPEN MINDS Market Intelligence Report—Trends In Affordable Care Act Health Insurance Marketplace Enrollment.

There are two factors that will drive impact for state provider organizations. These include the proportion of the state’s population covered by ACA Marketplace Plans and the proportion of the premium in that state that was covered by the subsidy.

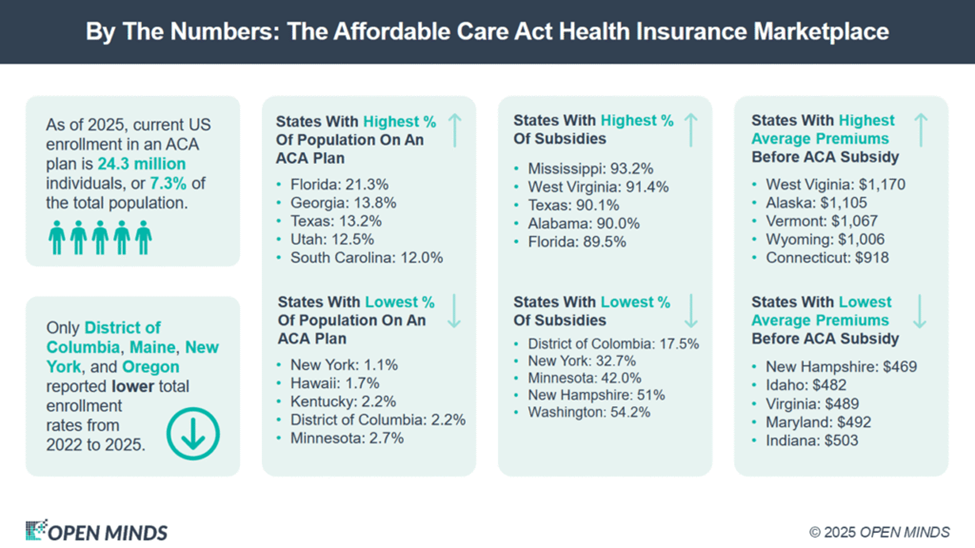

With regard to the first, our analysis found that the state with the highest proportion of the adult population covered by the ACA Marketplace Plans is Florida at 21.3%. Florida is followed by Georgia at 13.8% and Texas at 13.2%.

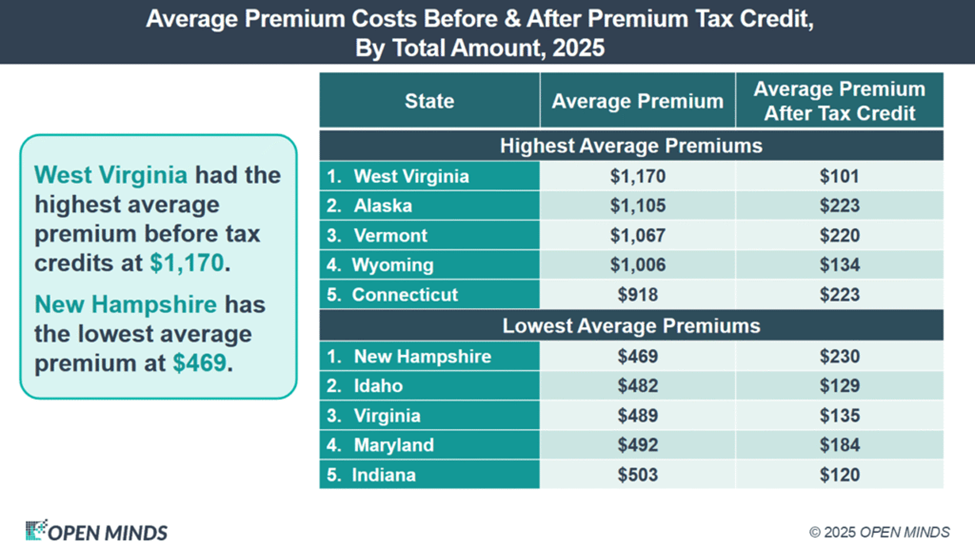

With regard to premium subsidies, the state with the highest proportion of premiums covered by the subsidy is Mississippi at 93.2%, followed by West Virginia at 91.4%, and Texas at 90.1%. States with the lowest proportion were District of Columbia (17.5%), New York (32.7%), and Minnesota (42.0%).

Looking at the intersection of these two factors, the states that will likely experience the highest impact from the end of the premium subsidies are Florida, Mississippi, Texas, Utah, South Carolina, Georgia, Alabama, and Tennessee.

To understand the impact of the ACA premium changes in every state, check out our new report—Trends In Affordable Care Act Health Insurance Marketplace Enrollment: An OPEN MINDS Market Intelligence Report. The report includes state-by-state enrollment and subsidy information over the last three years, average premiums before and after the premium tax credits, and a list of ACA plans in each state. As always, information on individual health plans can be found in our health plan database, the OPEN MINDS IntelligenceExplorer.

While the end of premium subsidies will affect all health care provider organizations, those with operations in the high-impact states will feel the effect more acutely. For executive teams, now is the time to relook at service line portfolio analysis—and estimate the financial impact of the decrease in insured consumers on each service.